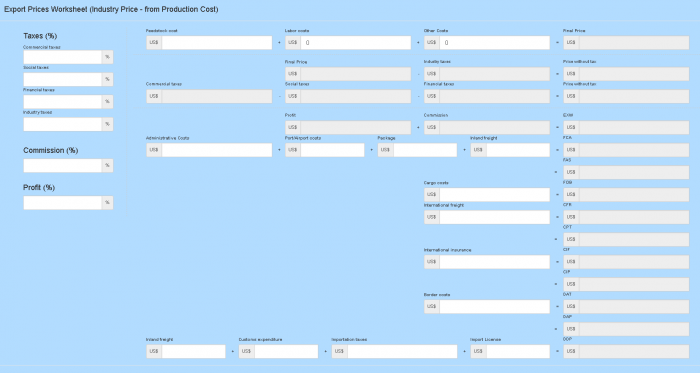

Export Pricing Worksheet for Industry

Export Pricing Worksheet for Industry

In order to verify that an export is viable the exporter must calculate and add up all the possible costs involved, calculate and include all the probable benefits and determine its profit margin, in order to find the final price of the product for export.

A well made spreadsheet will define whether it will be a good deal or a bad deal.

In the spreadsheet, whose form is available on the Intradebook platform, we include, in sequential order, the following items for export pricing:

Note that the basis of calculation can be done in two ways:

- Commerce´s Price: from the Price Practiced in the Domestic Market, which is when you buy a commodity for export, without manufacturing anything.

- Manufacturer’s Price: from the Cost of Production, which is when the good is manufactured for export.

This worksheet that we are going to present here is (b) Manufacturer’s Price: from the Production Cost, which is when the good is manufactured for export.

Export Pricing Worksheet for Industry

(Price of Industry – from Production Cost)

Production costs:

Cost raw materials in US$

+ Labor cost in US$

+ Other cost in US$

= Final basic price

Taxes (%): possible taxes on exportation

– Commercial Tax: percentage of trade tax, if applicable.

– Social Tax: percentage of social tax, if applicable.

– Financial Tax: percentage of the financial tax, if applicable.

– Industrial Tax: percentage of industry tax, if applicable.

Commission (%): percentage of commission to be paid to the representative, if applicable.

Profit (%): Percentage of profit you want to apply.

Items for Export Price Composition:

Price: inform your selling price, in US$

– Industrial Tax

= Price without Industrial Tax

– Sales Tax

– Social Tax

– Financial Tax

= Price without Taxes

+ Profit

+ Commission

= EXW price: ex-works price of the product

+ Administrative Expenses (administrative expenses for export)

+ Port Expenses (port expenses for export)

+ Packaging (product packaging expenses)

+ Inland Freight (cost of internal freight to the place of shipment)

= FCA price: price of the goods placed next to the carrier

= FAS price: price of the goods placed next to the carrier

+ Cargo Expenses (cost of shipment of merchandise)

= FOB price: price to place the goods on the carrier

+ International Freight (international freight cost to destination)

= CFR price: price of merchandise with international freight

= CPT price: price of merchandise with international freight

+ International Insurance (cost of international insurance until the destination)

= CIF price: price of merchandise with international freight and international insurance

= CIP price: price of merchandise with international freight and international insurance

+ Border Expenditure (expenses paid at the border for the release of the good)

= DAT price: price of merchandise placed in the terminal after the border

= DAP price: price of the merchandise ready to be unloaded from the carrier

+ Inland Freight at Destination (internal freight cost at destination)

+ Customs Expenditure at destination (customs expenditure paid at destination)

+ Destination Importation Tax (import tax to be paid at destination)

+ Destination Import License (cost of import license to be paid at destination)

= DDP price: price of goods at final destination with taxes paid

Export Pricing Worksheet for Industry

This worksheet is available for use online on the Intradebook platform.

Please note that although the Export Tax may be levied, it is an exception because no country charges a duty to export, except for controlled products or commodities.

We also divided taxes into four groups: Commercial, Social, Financial and Industrial. Each country has its own tax laws possibly with different names and for this reason we have made this division so that you choose the tax name option that best suits your reality. To fill in these fields, simply enter the percentages at the top left of the worksheet that the worksheet calculates automatically.

To better understand the terms of INCOTERMS see in the Intradebook blog our texts referring to INCOTERMS.

Source: Intradebook